Emailing Tax Receipts Batch:

Tax Receipts are emailed out when you select the “Send On Demand Alerts” when publishing.

Emailing Individual Tax Receipts:

Once your receipts have been published, and you wish to re-send or email or just one receipt. You can go into the payer’s account and email from there.

Steps to Follow:

- Go to Contacts and search for payer

- Select Payer’s Name

- Click on the “Finance” tab

- Click on the “Receivables” tab

- Click on the “Tax Receipts” tab

- Select the “Email” icon to the right of the Tax Receipt you wish to email

- Choose the Email category from the drop down list, tab off

- Click the “NEXT” button below the “email body”

- Click SEND to email out

- Click on the “Receivables” tab

Emails bounce back/ notifications:

- Emails notifications and bounce backs will appear in the inbox belonging to the email set up in your organization.

Email Reports/ Audit:

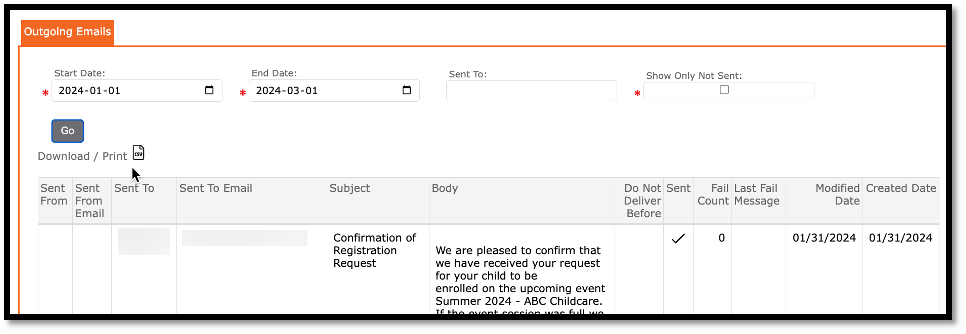

The “Outgoing Email” report provides information about emails sent out.

To access:

- Reports

- Operations

- Audit

- Outgoing Emails

- Operations

Information displayed:

- Sent From: Your organization’s Name

- Sent From Email: Your organization’s email

- Sent to: Contact’s Name

- Sent to email: Contact’s email

- Subject: Email subject title

- Body: Content sent in email.

- Do Not Deliver Before: pre-set date.

- Sent: checkmark = email has been sent

- Fail Count: displays a number representing number of failed outgoing emails

- Last Fail Message: Message describing the failure.

- Created Date: The date that the email was sent out.